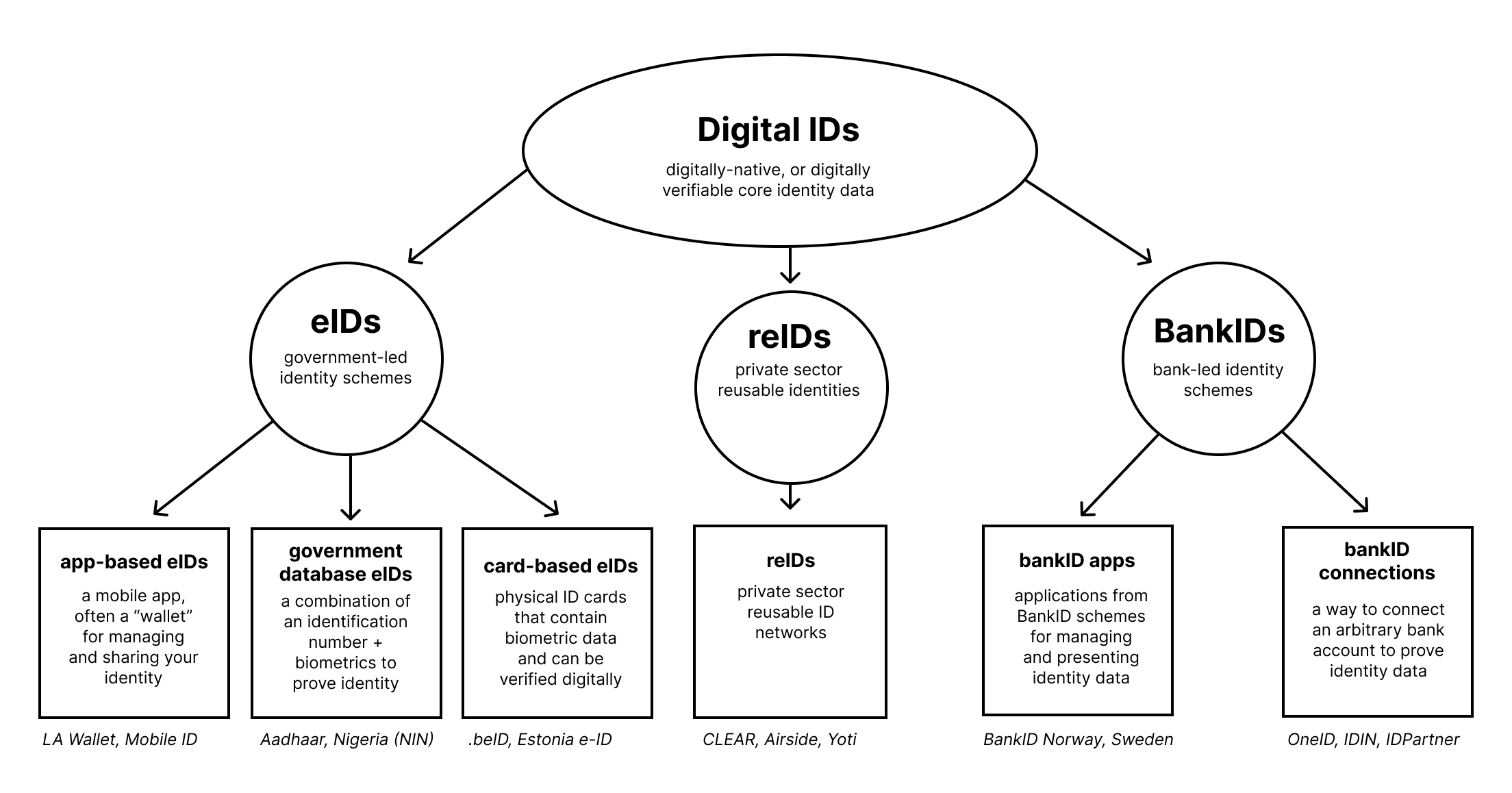

Types of Digital IDs

We categorize digital IDs available through Trinsic’s platform into three buckets:

- eIDs - Government-led identity schemes.

- reIDs - Private sector reusable identities.

- BankIDs - Bank-led identity schemes.

Within each of these buckets, there are additional distinctions that are helpful to understand when you’re integrating digital ID acceptance into your product.

- App-based eIDs are mobile applications, oftentimes a “wallet” where a user manages and shares their identity. Typically this means that a user will be directed with a QR code or deep link to a mobile application to complete a verification.

- Government database eIDs typically combine an identification number with biometrics to allow users to prove who they are.

- Card-based eIDs rely on the physical ID card with electronic capabilities allowing a user to complete a digital verification with high certainty. We don’t expose many of these methods, but they are available if needed.

- reIDs or Reusable IDs are private-sector verified identities that can be shared with the user’s consent. These could either be app-based, or simply use a login flow in a web view.

- BankID apps allow users to manage and present identity data from a bankID scheme using a mobile app. This means the user simply authenticates in the application and consents to sharing their data.

- BankID connections utilize open banking to allow a user to connect to an arbitrary bank account and prove their identity data. This typically requires the user to log into their banking provider through a web portal on mobile or desktop.

For each of our ID providers we list the category of digital ID so you have an understanding of each user journey.

Updated 2 months ago